Navigating customs clearance can be complex for businesses involved in international trade. Even the minor errors can cause delays, fines, and increasing costs. It’s essential to understand the most common customs clearance mistakes and how to prevent them for smooth shipping and compliance.

Inaccurate Customs Declarations

One mistake businesses often make is submitting incorrect customs declarations. Providing incomplete or inaccurate information can result in shipments being held up at the border or facing penalties.

How to Avoid This Situation?

It’s suggested to make sure that all the required details like the consignee’s information, shipment value, and country of origin, are stated correctly on the customs declaration form. Check the entries thoroughly before submission to reduce errors.

Incorrect HS Codes

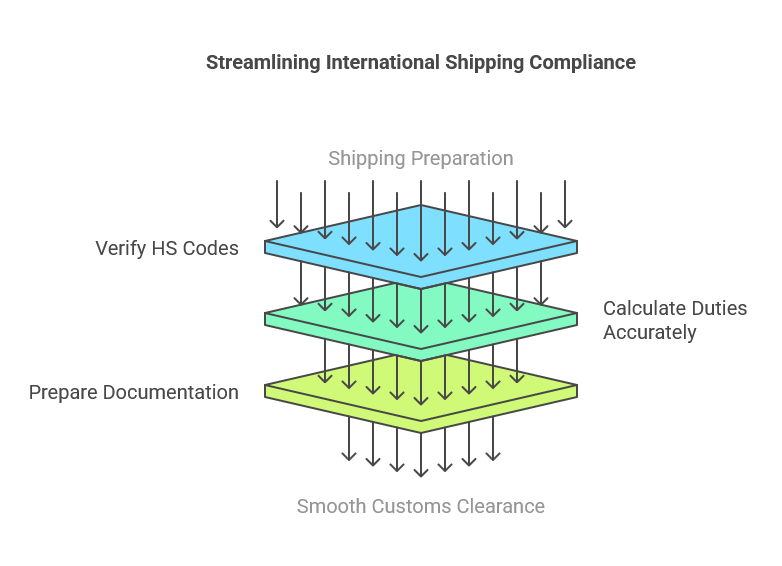

Harmonized System (HS) codes help with good classification for import and export. Using the wrong HS code can cause incorrect duty payments, penalties, or shipment delays.

How to Avoid It?

The businesses should verify HS codes before shipping. They can use official databases, consult with a customs broker, or seek guidance from the World Customs Organization (WCO) to determine the correct classification. It is also important to note that HS codes are specific to countries. So its important to use the correct code for the country of Import.

Miscalculating Custom Duties and Taxes

Misestimating duties and taxes can badly impact cash flow and result in unexpected charges. Once paid, it is a lengthy process to apply and get a refund.

How to Avoid It?

The businesses need to use duty calculators or consult customs professionals for accurate duty and tax assessments. Understanding trade agreements and tariff exemptions can help them reduce costs.

Lack of Proper Documentation

Customs officials require certain documents, including invoices, bills of lading, certificates of origin and in some cases certificates or licences. Missing or incorrect paperwork can delay the customs clearance process or lead to shipment rejection.

How to Avoid It?

The businesses must prepare every necessary document well in advance. They can create a checklist to ensure the compliance with the destination country’s requirements. Experienced customs clearing agents like 121 Air Sea Cargo liaise with shipper and consignee in advance to thoroughly check and finalise the documents.

Undervaluing or Overvaluing Shipments

Providing an incorrect value for goods can result in fines or additional scrutiny.

How to Avoid It: Accurately declare the true value of shipments. Maintain thorough records and ensure that invoice amounts match the declared values.

Failing to Comply with Import Restrictions

There are certain products that may require special permits or be subject to restrictions in specific countries. It is important to ensure the product is sourced from an approved supplier.

How to Avoid It?

Do thorough research on import regulations before shipping. They can consider working with customs authorities or legal experts to ensure compliance with the import restrictions.

Not Using a Customs Broker Whenever Required

For businesses new to international shipping, navigating customs procedures without expert assistance can lead to expensive mistakes.

How to Avoid It?

It’s better to rely on a licensed and expert customs broker like 121 Air Sea Cargo who can ensure compliance with regulations, help with documentation, and expedite clearance.

Final Conclusion

To avoid these customs clearance mistakes, businesses need to do thorough preparation, accurate documentation, and a solid understanding of regulations. They should focus on HS codes, duty calculations, and compliance requirements to manage their customs processes and prevent costly delays. Maintaining due diligence in every step of the shipping process will significantly contribute to smoother international trade operations and improved efficiency. For more information about customs clearance policies, please contact 121 Air Sea Cargo at + 44 (0) 20 8313 1777.